who claims child on taxes with 50/50 custody pennsylvania

The IRS has put rules in place to make tax filing fair for parents who have 5050 custody. Heres what it does say.

Who Claims A Child On Taxes With 50 50 Custody In California Her Lawyer

The custodial parent as defined by the IRS claims the child tax credit in a 5050 division.

. The one who had custody for more than 12 of the year can claim the child as a dependent child care expenses earned income tax credit and if eligible Head of Household. However if the child custody agreement is 5050 the IRS allows the parent with the. Typically when parents share 5050 custody they alternate between odd and even years on which parent claims the child.

Learn the circumstances under which a parent. If either parent has signed a Release of Claim to Exemption for Child of Divorced or Separated Parents that individual will have essentially forfeited his or her right. Back to top Pennsylvania.

Who claims the minor child on their income tax in pennsylvania when the parents were never married and have a 5050 - Answered by a verified Tax Professional. California law states that in split 5050 child custody agreements the parent with the higher income can claim the child as a dependent on taxes. You must meet the following qualifications to claim.

In the event of a 5050 custody schedule child support in Pennsylvania is payable to the parent with the lower income by the parent with the higher income. The following arrangements were written into Joint Parenting Agreements during mediation prior to. If the father claims the exemption without filing this form he may have to prove that he furnished over 50 of the support for the kids if the IRS questions his return.

Tax law mentions custodial and noncustodial parents but does not mention joint physical custody or 5050 custody. Shared custody can create a situation where one parent gets to claim the child as a dependent. For a confidential consultation with an.

Contact an Experienced Attorney. Yes if you earn more than the childs other parent you will need to pay child support in Pennsylvania even if you have 5050 custody. Answer 1 of 6.

Whoever has custody for the greater part of the year as often stipulated in the divorce settlement typically gets to claim the child unless the court rules otherwise. My soon to be ex husband and I have decided to go for shared parenting with an exact 50 split of the time with our little. Child Tax Credits With 5050 Shared Custody.

A release has been signed. In a joint custody agreement the custodial parent can claim the child as a dependent on their tax returns. In this way both parents if eligible have the.

Who Claims a Child on Taxes With 5050 Custody. However most cases involve. Im not a tax or legal pro so this is just my personal experience.

Generally IRS rules state that a child is the qualifying child of the custodial parent and the custodial parent may claim the child. Basically the custodial parent claims the dependent child for tax benefits. Who claims the minor child on their income tax in pennsylvania when the parents were never married and have a 5050 - Answered by a verified Tax Professional.

Once it has been determined. The only exception to this is if the court says otherwise or if the custodial parent signs a form called the Release of.

Family Law In Southwestern Pa Elizabeth A Parker

Divorce Law In The Fifty States Of Pennsylvania Divorce Lawyer In Pa

What Happens If Parents With Joint Custody Live In Different School Districts Jennifer Courtney Associates P C

Who Claims Taxes On Child When There S 50 50 Custody

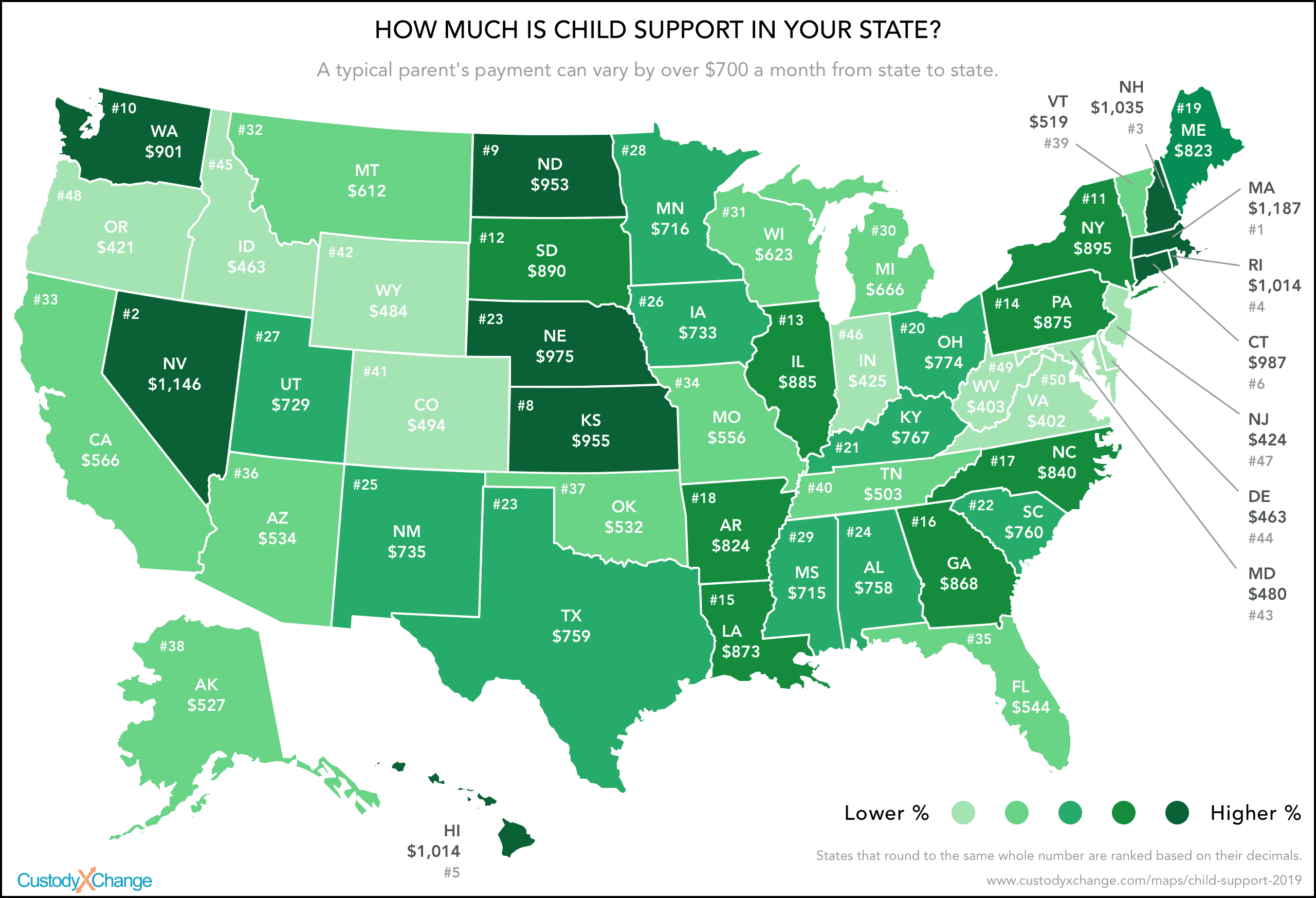

How Much Is Child Support In Your State Custody X Change

Shared Custody And A Child Care Tax Deduction

:max_bytes(150000):strip_icc()/114274370-56a870af3df78cf7729e1a2a.jpg)

Irs Tiebreaker Rules For Claiming Dependents

Parnell Drops Out Of Senate Race Following Ruling That Estranged Wife Gets Legal Custody Of Children Pittsburgh Post Gazette

How Child Support Is Calculated In Pennsylvania Cooley Handy Blog

Do I Have To Pay Child Support If I Have 50 50 Custody The Martin Law Firm

What Are The Challenges Of A 50 50 Custody Split

Goodtherapy Can Mental Health Issues Be Used Against You In A Child Custody Dispute

My Ex Claimed The Kids On His Taxes When It Was My Turn

Who Claims A Child On Us Taxes With 50 50 Custody

Joint Custody School Choice Child Custody Attorney Doylestown

Do Father S Have Custody Rights In Pennsylvania

Covid And Child Custody Cga Law Firm

5 Things To Know About Child Support Modifications

Is Child Support Necessary If The Parents Split Custody 50 50 Fort Lauderdale Child Supprt Lawyer